net operating working capital formula

But net operating working capital that. NWC total assets - total liabilities.

:max_bytes(150000):strip_icc()/WORKING-CAPITAL-FINAL-SR-16dac45bb5fb4f0cad62cd706c59e0cd.jpg)

Working Capital Formula Components And Limitations

Pvt Ltd is as follows.

. The formula for each company will be different but the basic structure always includes three components. Cash and Cash. To calculate total operating.

It includes inventories accounts receivables fixed assets etc. As per the above table the Net Working Capital of Jack and Co. Accrued Expenses 10 million.

Net Working Capital Formula Current Assets Current Liabilities. Cash Accounts Receivable Inventory Accounts Payable Accrued Expenses. Based on the above calculation the Net.

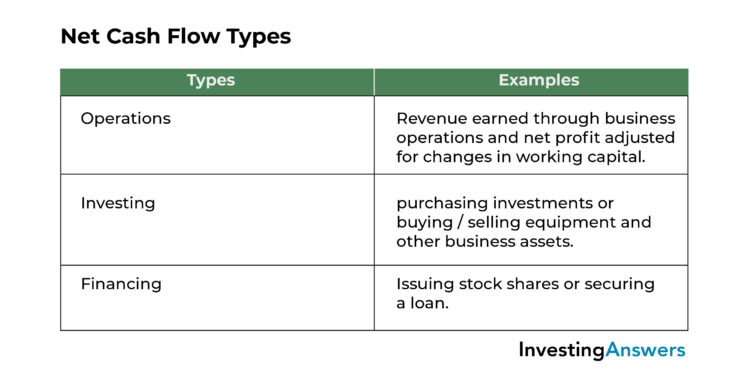

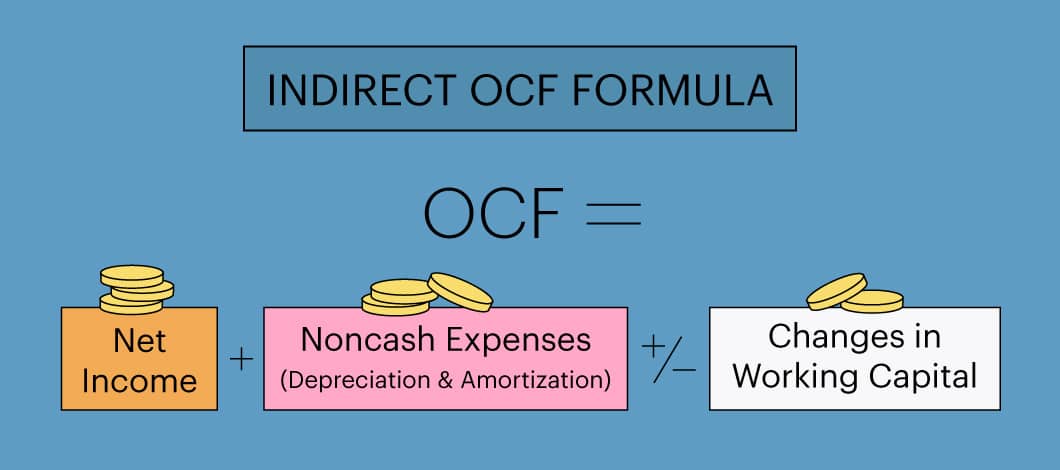

The net working capital NWC ratio is the comparison of the percentage of a companys current assets to its short-term liabilities. 1 net income 2 plus non-cash expenses 3 plus the net. Given those figures we can calculate the net working capital NWC for Year 0 as 15mm.

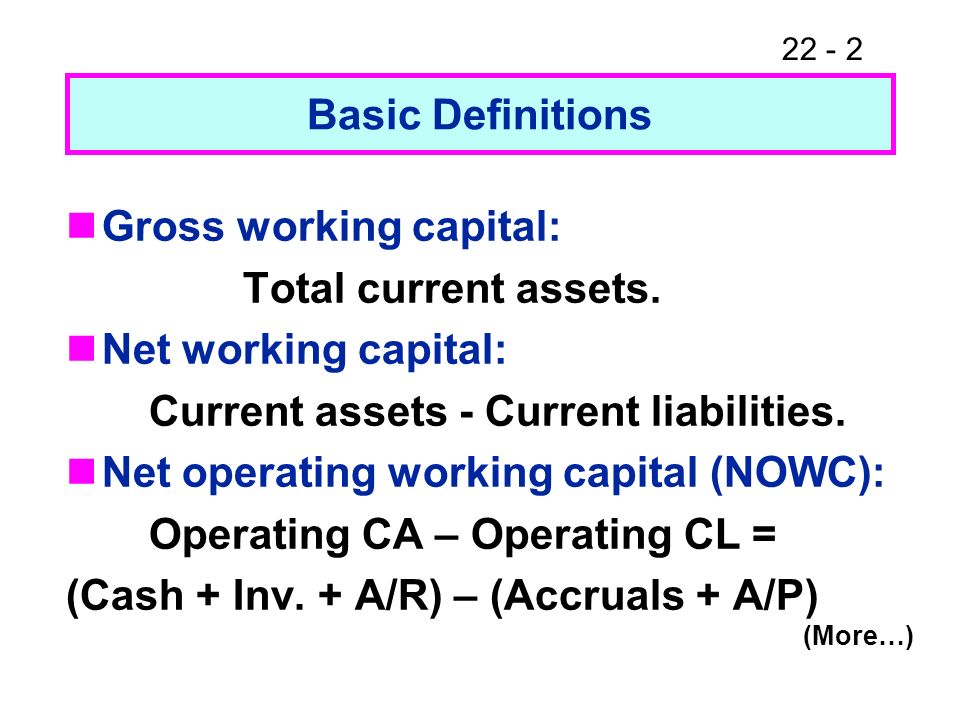

Net working capital also includes net operating working capital the difference between a companys current operating assets and operating liabilities. By providing a monetary. Total net operating capital represents all the current and non-currents assets used by a business in its operations.

Net working capital 106072 98279. This metric is much more tied to cash flows than the net working. By calculating the sum of each side the following values represent the two inputs required in the operating working capital.

Net working capital 7793 Cr. Working Capital Turnover Ratio 288. Net Working Capital is Assets Liabilities - 10000.

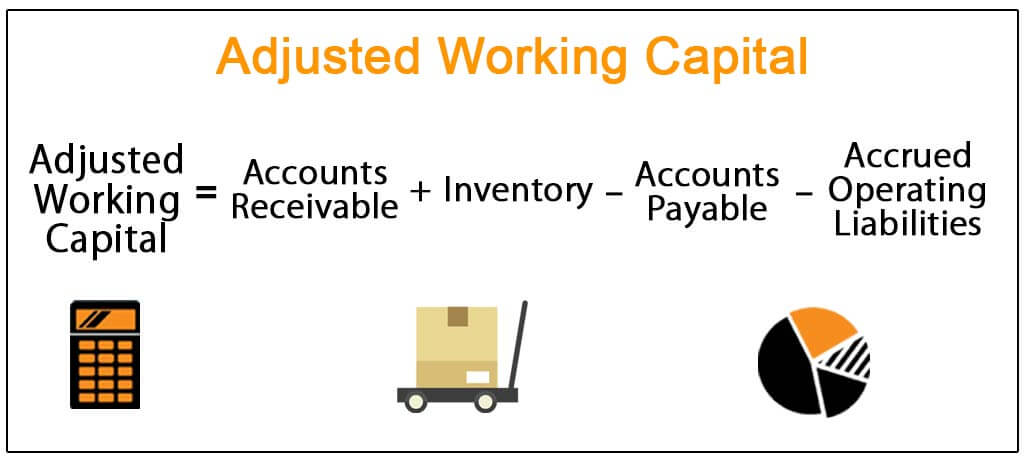

The net operating working capital formula is calculated by subtracting working liabilities from working assets like this. In essence the NOWC is part of the TOC. Working Capital Turnover Ratio Rs 1150000 Rs 400000.

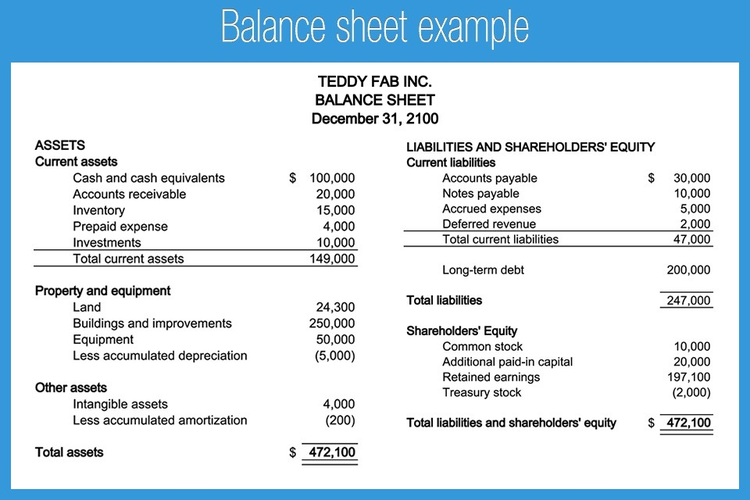

Net Working Capital Total Current Assets Total Current Liabilities. The net operating working capital or NOWC is the value in excess of a companys operating current assets over the operating current liabilities. Working capital is a measure of both a companys efficiency and its short-term financial health.

Working Capital Turnover Ratio Turnover Net Sales Working Capital. Net operating working capital NOWC is the difference between a companys current assets and current non-interest bearing current liabilities. The formula for calculating net operating working capital is.

Deferred Revenue 5 million. Starting from net income non-cash expenses like depreciation and amortization DA are added back and then changes in net working capital NWC are accounted for. The ratio is used to determine whether a.

Unlike operating working capital you do not need to remove cash securities or non. Current assets include cash. Accrued Expenses 20mm.

Working capital is calculated as. Once the Net Working Capital is calculated you can scrutinize how you can use the balance whether you want to make improvements in. What is the difference between net operating working capital and the total operating capital.

Current Operating Assets 50mm AR 25mm Inventory 75mm. The formula for calculating net working capital is.

Adjusted Working Capital Definition Formula Example

Net Operating Working Capital And Cash Flow Download Table

Net Operating Working Capital And Cash Flow Download Table

Net Cash Flow Formula Definition Investinganswers

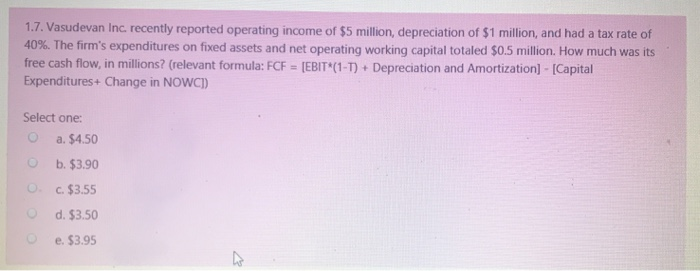

Solved 1 7 Vasudevan Inc Recently Reported Operating Income Chegg Com

Chapter 22 Working Capital Management Ppt Video Online Download

Working Capital Requirement Wcr Agicap

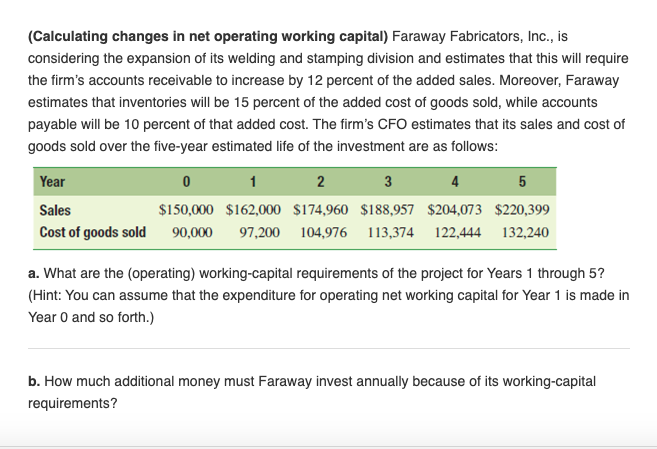

Solved Calculating Changes In Net Operating Working Chegg Com

A Small Business Guide To Calculating Net Working Capital

Nowc Net Operating Working Capital By Acronymsandslang Com

Working Capital Management Acca Global

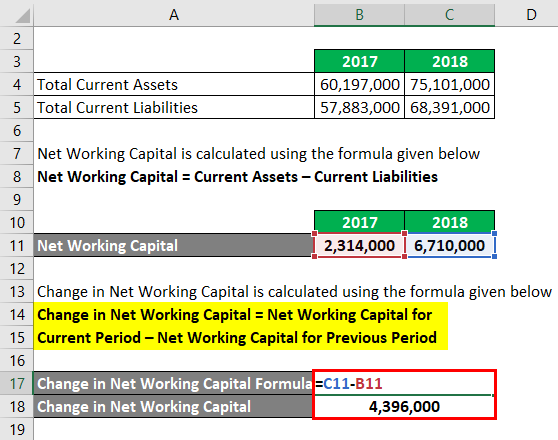

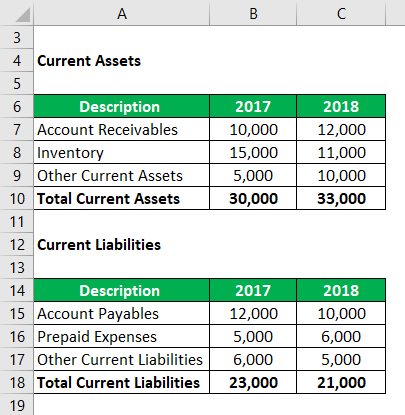

Change In Net Working Capital Formula Calculator Excel Template

Change In Net Working Capital Formula Calculator Excel Template

Solved What Is Talbot Enterprises Net Operating Profit After Taxes Course Hero

Working Capital Turnover Formula And Calculator Step By Step

Working Capital Management Explained How It Works

How To Find Operating Cash Flow Learn To Calculate It With Examples